Bruce Power is expanding its clean-energy financing efforts with plans to issue an additional $950 million in Green Bonds, reinforcing its role in supporting Ontario’s economy through major operational and infrastructure initiatives.

The utility has priced its latest Green Bond offering as a private placement across Canadian provinces, with the transaction officially closing on December 8, 2025. This marks another milestone in the company’s ongoing use of sustainable financing tools.

Since becoming the first nuclear operator globally to issue Green Bonds in 2021, Bruce Power has now raised a cumulative $3.3 billion through five separate issuances. The company’s latest financing effort aligns with provincial policy changes introduced in January 2024, when Ontario updated its Sustainable Bond Framework to include nuclear energy for the first time. The framework recognizes nuclear projects that produce electricity or heat as eligible within the Clean Energy category, broadening access to sustainable financing for initiatives contributing to the province’s long-term environmental goals.

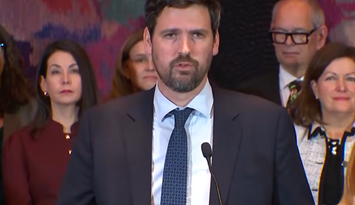

“Bruce Power’s latest Green Bond issuance is another strong vote of confidence in Ontario’s clean energy advantage,” said Stephen Lecce, Minister of Energy and Mines. “As our government doubles down on nuclear expansion, we’re attracting major investment and confidence in our clean energy future. We are proud to work with Bruce Power to strengthen the infrastructure that powers our communities, supports good-paying jobs, and keeps costs down for families.”

Company leadership says the financing supports critical long-term initiatives.

“Bruce Power is committed to nuclear’s role in a clean energy future and Canada’s energy independence,” said Kevin Kelly, Bruce Power Executive Vice-President and Chief Financial Officer. “Our Green Bonds allow investors to participate in one of Canada’s largest clean-energy infrastructure investments with Bruce Power’s Life Extension Program and other projects, allowing us to provide non-greenhouse-gas-emitting electricity to Ontario for decades to come.”

The company revised its Green Financing Framework in November 2023, earning a ‘Medium Green’ rating from S&P Global Ratings - an assessment that also confirmed alignment with the Green Bond Principles and Green Loan Principles.

Bruce Power continues to advance large-scale clean energy projects, including the Major Component Replacement (MCR) program, which will refurbish Units 3 through 8 by 2033. Unit 6 returned to service ahead of schedule and under budget in 2023, and refurbishment outages for Units 3 and 4 remain on plan. The company also played a key role in Ontario’s 2014 coal phase-out and contributes to a range of environmental and sustainability initiatives across the province.

As part of its corporate mandate, Bruce Power aims to strengthen sustainability performance, reduce environmental impacts, and uphold strong governance practices.

The new Green Bonds are being marketed through a syndicate of agents led by BMO Capital Markets, RBC Capital Markets, and TD Securities, with additional participation from Scotia Capital, CIBC World Markets and National Bank Capital Markets.